There’s something for everyone in the One Big Beautiful Bill Act of 2025. In fact, the Tax Foundation calculated that the new law avoided a tax hike on 62 percent of tax filers in 2026. In dollars and cents, that works out to almost $3,800 in taxes for each taxpayer.

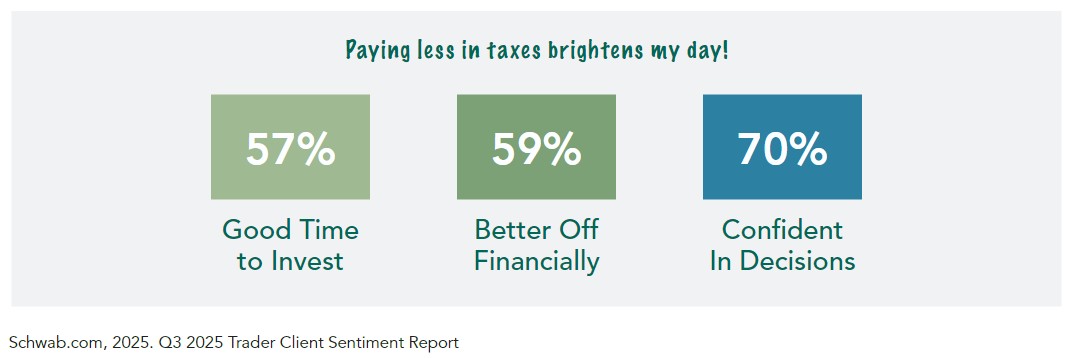

Optimistic Outlook

Schwab’s second-half 2025 Client Sentiment Report asked 1,323 investors about the current state of their personal finances.

As you can imagine, I’m getting a lot of questions about the new rules, many of which focus on tax brackets and deductions. So here’s a quick recap of some of the updated rules expected to have the widest impact:

The current tax rates of the 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent brackets have been extended. Had the Tax Cuts and Jobs Act of 2017 expired, the rates would have reverted to 10, 15, 25, 28, 33, 35, and 39.6 percent.

The standard deduction is $15,750 for single filers and $31,500 for those married filing jointly in 2025.The best part is that it will adjust for inflation starting next year!

The new “bonus” deduction for older Americans raises the most questions. Here’s what you need to know: starting in 2025, the bill provides a $6,000 bonus deduction for filers 65 and up. The deduction begins to phase out for individuals with incomes starting at $75,000, or joint filers with an income of $150,000.

Please let me know if you have any questions about these updated rules or any other changes. I’ll be happy to pass along any information that I might have.

Also, this may be a good time to discuss the changes with your tax, legal, or accounting professional.

Remember, some changes will start this year, while others will kick in in 2026. Like previous tax laws, some of the new rules are scheduled to expire, while others are permanent. So, I would encourage you to take some time to get familiar with the updated rules and take a proactive approach.

TaxFoundation.org, 2025, “The One Big Beautiful Bill Cuts Taxes Across the US, New Analysis Finds”

CNBC.com, July 3, 2025, “Tax changes under Trump’s ‘big beautiful bill’ — in one chart”

Congress.gov, August 21, 2025, “H.R.1 – One Big Beautiful Bill Act”

DISCLOSURE

This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG Suite is not affiliated with the named broker-dealer, state- or SEC-registered investment advisory firm.

This is for informational purposes only and is not a replacement for real-life advice. Consult your tax, legal, and accounting professionals before modifying

your tax strategy